Council confirms total council tax rise for next year for Hartlepool residents

At the end of last year Hartlepool Borough Council approved increasing its council tax by 3.9%, including the 1% adult social care precept.

Council leader Coun Christopher Akers-Belcher said at the time the council was left with ‘no choice’ after nine years of government cuts.

Advertisement

Hide AdAdvertisement

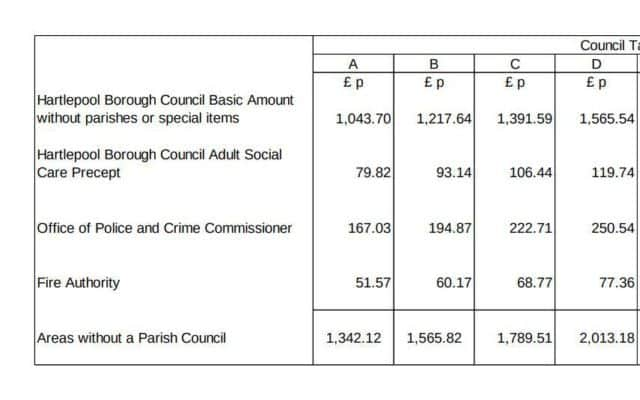

Hide AdThe council tax contributions to the Police and Crime Commissioner and Cleveland Fire Authority have now been confirmed and when the overall rise is calculated it means the total rise for areas without a parish council will be 4.6%.

Areas with a town or parish council may also have an extra council tax cost added on.

The Cleveland Police and Crime Commissioner increase is based on a £24 rise for a Band D property, which equates to 10.6% for all property bands.

Cleveland Fire Authority moved to increase its council tax share by 2.9% earlier this month after hitting out at the Government for nine years of cuts to its funding, stating it had been ‘cut to the marrow’.

Advertisement

Hide AdAdvertisement

Hide AdFor a property in Band A, which 53% of Hartlepool households are, the annual council tax will rise by £59.62.

Out of this, £42.17 more will go to Hartlepool Borough Council (including the 1% adult social care precept), £16 will go the Police and Crime Commissioner and £1.45 will go to the Cleveland Fire Authority.

Council bosses also confirmed it received its final 2019/20 Local Government Finance Settlement, which showed government funding was £18.135million, £1,000 less than expected when the council confirmed its budget in December last year.

Coun Christopher Akers-Belcher said: “The final 2019/20 Government grant figures were issued as late as the 29th January this year and this basically confirmed the figures issued in December, although there has been a further cut in Hartlepool’s final grant, but only of £1,000.

Advertisement

Hide AdAdvertisement

Hide Ad“More importantly these figures confirm that over the last nine years, funding has been cut by 45%, a reduction of £20.9million.

“The Government council tax referendum limits continue to shift the burden of funding services in Hartlepool onto council tax payers.”

In total Band A properties in areas without a parish council, will pay £1,342.12 in council tax for the year, with £1,123.52 going to the council (including the adult social care precept), with £167.03 going to the office of the Police and Crime Commissioner and £51.17 going to Cleveland Fire Authority.

The report which went before full council also showed the drop in government funding means in 2019/20 council tax will fund 62% of council expenditure, compared to 50% in 2015/16.

Advertisement

Hide AdAdvertisement

Hide AdCoun Akers-Belcher also noted a recent House of Commons report titled ‘Local Government Spending’ which showed all councils are facing financial challenges.

He highlighted the report also states: “There is still no sign that the department has a clear plan to secure the financial sustainability of local authorities in the long-term.”

Nic Marko , Local Democracy Reporting Service