Hartlepool council tax warning as finance chief warns at least 3% rise in bills needed to keep finances 'robust'

and live on Freeview channel 276

Hartlepool Borough Council finance officers have warned upcoming decisions over council tax rates will be ‘probably the most important decisions that will ever be made’ in regards to the authority’s budget.

The council’s Finance and Policy Committee will on Monday make budget recommendations for 2021/22, including the council tax rate, which will then go before all councillors for final approval.

Advertisement

Hide AdAdvertisement

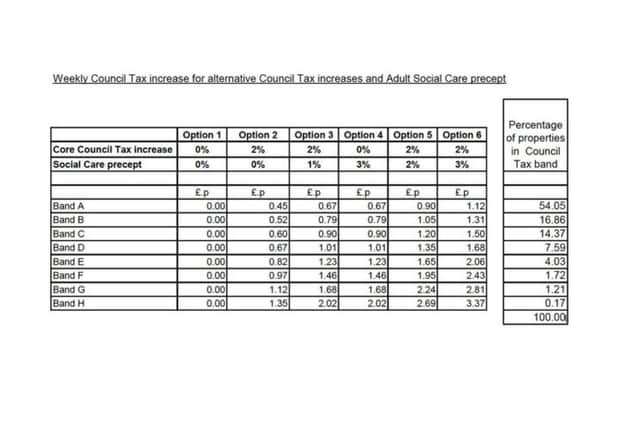

Hide AdA report ahead of the meeting from Chris Little, council director of resources and development, warned the most ‘sustainable option’ would be to increase council tax bills by 5%.

This would be made up of a 2% increase of core council tax, along with a 3% adult social care precept, the maximum increase allowed by the Government’s limits.

He also branded claims by the Labour Group that a 5% increase would be proposed as ‘fake news’.

Maximum rise in council tax ‘most sustainable option’

Advertisement

Hide AdAdvertisement

Hide AdMr Little, in his report, states the decisions made in regards to the budget will ‘provide the financial foundations’ for the council’s future ahead of the all out election planned for May this year.

He said: “The Government’s national council tax policy for 2021/22 continues to shift funding of local services from national taxation on to council tax.

“The decisions members make in relation to the 2021/22 budget are probably the most important budget decisions that will ever be made as they provide the financial foundations and legacy for the new council to be elected in May 2021.

“The most sustainable option for the council is to implement the maximum increase in council tax and the adult social care precept allowed by the Government’s referendum limits.

Advertisement

Hide AdAdvertisement

Hide Ad“For the avoidance of doubt, any proposals to increase total council tax (including the adult social care precept) by less than 3% would not, in my professional opinion, be robust.”

He added the second most sustainable option would be a 2% core council tax increase, with an element of the adult social care precept implemented in 2021/22 and the balance deferred to 2022/23.

The third most sustainable option would be to implement the full 3% adult social care precept in 2021/22 and no core council tax increase, according to officers.

Mr Little’s report also looked at the longer term impacts of setting various levels of council tax.

Advertisement

Hide AdAdvertisement

Hide AdIf no council tax rise or adult social care precept were implemented, the council would defer a deficit of just over £4million to 2022/23.

This would mean they would have to use around £5.2million from the council’s budget support fund for 2021/22, leaving around £3.4million uncommitted for future years.

If an overall 5% increase was implemented, the council would receive an additional £2.135million in recurring council tax and adult social care precept income and would defer a deficit of £1.912million to 2022/23.

In that instance just over £3million would have to be used from the council’s budget support fund, leaving over £5.5million uncommitted going forward.

Advertisement

Hide AdAdvertisement

Hide AdMr Little adds funding increases for local government ‘will not be a priority’ going forward and future financial issues are likely to be faced in the coming years.