Hartlepool Borough Council confirms households' final council tax bills for the coming year

and live on Freeview channel 276

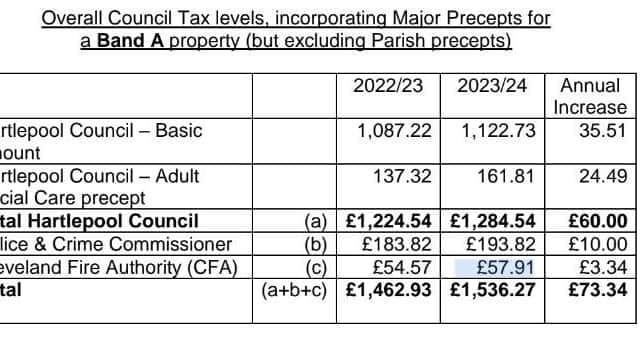

In January Hartlepool Borough Council approved a 2.9% increase in core council tax and a 2% rise in the adult social care precept for 2023/24, in line with Government expectations.

At Thursday’s full council meeting councillors received an update on their final funding settlement from the government, and confirmed the overall council tax calculations for the coming year.

Advertisement

Hide AdAdvertisement

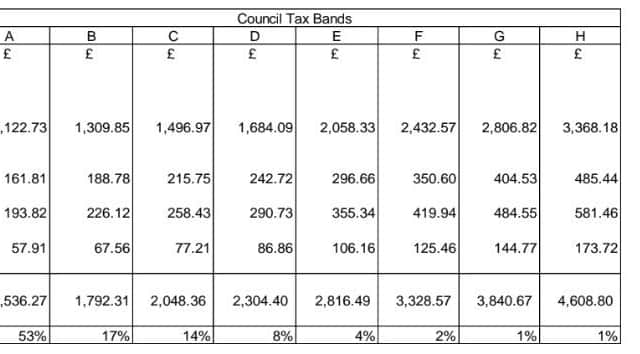

Hide AdBand A properties not covered by a parish council, which account for the majority of households in the borough, will pay £73.34 a year more in council tax in 2023/24 compared to this year.

This reflects the rise backed by the council and the increases decided independently by the Police and Crime Commissioner and Cleveland Fire Authority.

Cleveland Police and Crime Commissioner increased its council tax precept by £15 for for Band D properties for 2023/24, equating to a £10 rise for Band A homes.

Meanwhile Cleveland Fire Authority implemented a £5 rise for those in Band D, equating to an extra £3.34 on the bills of Band A households to go towards supporting the fire service.

Advertisement

Hide AdAdvertisement

Hide AdProperties covered by a parish council in Hartlepool, which accounts for just 8.5% in the borough, will also have a parish precept payment on their council tax bills.

Excluding those properties, this means Band A households will see their annual council tax bill rise from £1,462.93 to £1,536.27, equating to a £1.41 weekly rise.

In total £1,284.54 will go to the council, including the adult social care precept, £193.82 to the office of the Police and Crime Commissioner and £57.91 to Cleveland Fire Authority.

The statutory calculations were approved by majority vote at the meeting at Hartlepool Civic Centre.

Advertisement

Hide AdAdvertisement

Hide AdCouncil leader Councillor Shane Moore previously said he was “disappointed that the national funding system continues to shift the burden of funding council services from Central Government to local taxpayers” and they continue to lobby for a fairer system.

The meeting also heard the council’s final funding settlement from Government is £45,000 more than expected.

This will reduce the approved use of the council’s budget support fund from £1.516m to £1.471m, allowing it to instead be used to support financial decisions in future years.